Europe’s factories, shipyards, and energy plants face a sustained skills shortage. Choosing the right Vietnam labour export company gives employers a compliant, predictable way to secure certified talent while protecting quality, safety, and budgets. This supporting article distills the must-know criteria EU buyers should apply when shortlisting a partner, and it complements our pillar resource on policy and process. For legal frameworks and end-to-end procedures, see the Vietnam labour export guide 2025.

Why a Vietnam Labour Export Company Matters for EU Projects (Quality, Compliance, Speed)

Choosing a Vietnam labour export company is not only about visas and paperwork. It is about repeatable outcomes: certified talent, verified documentation, and predictable onboarding across EU worksites. Mature providers maintain KPI dashboards for first-pass quality, retention and deployment speed, so procurement teams can plan shutdowns and commissioning windows with confidence. This operational discipline turns labour planning into a measurable, low-risk process for European employers.

Across the EU, critical projects are delayed by shortages in welding, fitting, fabrication, hospitality, logistics, and care jobs. A vetted Vietnam labour export company solves three hard problems at once: skills alignment to European codes, regulatory compliance across jurisdictions, and consistent deployment within defined timelines. The best agencies offer transparent testing, contract discipline, and welfare management that stand up to audits and client due diligence.

Skills & Certification Alignment (EN/ISO, Sector Fit)

Reputable partners map trade skills to the destination country’s standard—e.g., EN ISO 9606-1 for welding, food safety standards in hospitality, or GMP awareness in food/pharma utilities. They pre-test skilled workers against the job’s overseas employment demands and share evidence: test videos, assessor notes, and acceptance criteria. This reduces rework, accelerates onboarding, and safeguards first-pass quality.

Documentation Discipline & GDPR

Audit-ready document packs include contracts, insurance, medicals, permits, and privacy notices. A mature export labor service maintains encrypted archives, role-based access, and retention policies. When inspectors or client auditors ask, proofs are available in minutes—not days—saving real money on stoppages and administrative churn.

Internal link: For the wider policy context and visa pathways, consult our Vietnam labour export guide 2025.

Checklist to Verify a Legitimate Vietnam Labour Export Company (2025)

Not all providers operate to the same standard. Before signing, apply this practical due-diligence checklist to any Vietnam labour export company pitching your business:

Licences & Government Registers

- Valid MOLISA licence (name, number, and scope) and up-to-date compliance letters.

- Named legal representative, tax code, and registered training/testing addresses.

- Ability to provide sample contracts in Vietnamese and destination language.

Testing Facilities & Shortlisting Process

- In-house test bays with EU-comparable equipment; proctored, scored assessments.

- Transparent, time-stamped media (photos/videos) and assessor sign-offs.

- Shortlists built from skill matrices, not generic CV lists; employer-specific trials on request.

Client References & Warranty Terms

- Recent reference projects with contactable EU clients and documented KPIs.

- Retention/Replacement guarantees (e.g., 90–180 days) in the master agreement.

- Clear escalation workflow and service credits for missed deployment milestones.

External credibility: Cross-reference labour mobility with EURES – EU labour mobility insights, and verify Vietnamese licence data with relevant MOLISA resources.

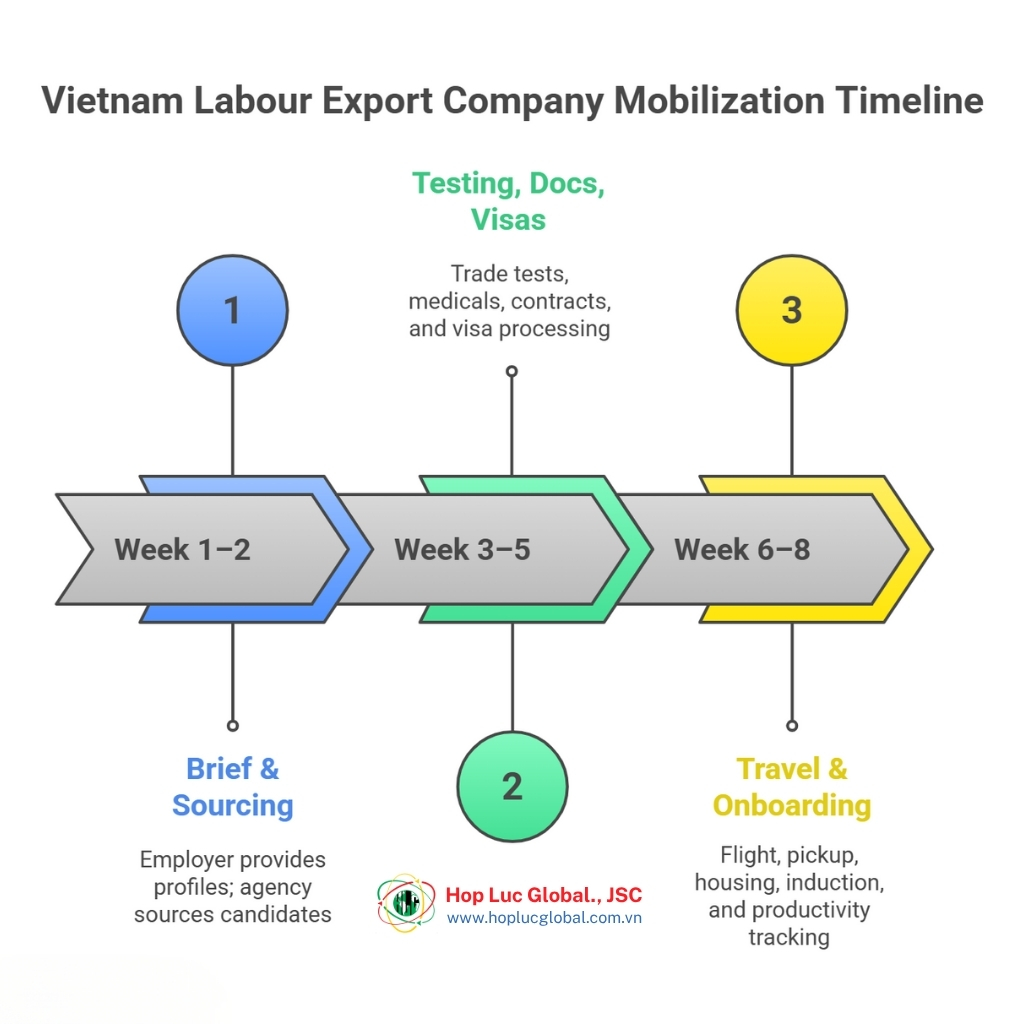

Shortlist to Site: How a Vietnam Labour Export Company Mobilizes in 30–60 Days

Predictability is a key reason European employers select a Vietnam labour export company. Below is a realistic timeline used by mature providers. Link this to your shutdowns, commissioning windows, or seasonal peaks.

Week 1–2: Brief & Sourcing

- Employer sends role profiles, codes/standards, language level, welfare specs.

- Agency launches targeted sourcing via schools, guilds, and regional partners.

- Pre-screen by CV + video; shortlist invitation to test center.

Week 3–5: Testing, Docs, Visas

- Hands-on trade tests; medicals, insurance, and police checks.

- Contract issuance; embassy appointments scheduled; file is GDPR-secure.

- Pre-departure orientation covers safety, culture, and workplace communications.

Week 6–8: Travel & Onboarding

- Flight, airport pickup, housing verification, and local registrations.

- Site induction, PPE/tool allocation, and supervisor language pairing.

- First-week productivity goals tracked against workfront plan.

| Phase | Owner | Key Output | Typical Duration |

|---|---|---|---|

| Brief & Sourcing | Employer + Agency | Role spec, shortlist slots | 7–14 days |

| Testing & Documents | Agency | Test results, visas, insurance | 14–21 days |

| Deployment & Onboarding | Agency + Employer | Arrival, induction, first-week plan | 7–14 days |

To keep schedules intact, your Vietnam labour export company should align weekly look-ahead plans with NDT, scaffolding and QA milestones. When testing, visas and housing are tracked in one shared sheet, hand-offs become smoother, hydrotest targets hold, and idle hours drop. This is the difference between a transactional recruiter and a true operations partner for EU projects.

Comparing Providers: Vietnam Labour Export Company vs. General Recruiter vs. Broker

Different models carry different risks. Use the matrix below to protect cost, quality, and reputation.

Cost vs. Total Cost of Ownership (TCO)

- Specialist agency: Higher upfront diligence; lower rework, churn, and admin cost; stable TCO.

- General recruiter: CV-forwarding; hidden costs in retesting, documentation, and training.

- Broker: Lowest upfront price; highest risk of delays, non-compliance, and reputational damage.

Risk & Accountability

- Who owns compliance? A true Vietnam labour export company does—via licences, welfare, and auditable files.

- Who replaces underperformers? Look for written service levels and defined remedy windows.

- Who manages welfare and CSR? Ask for housing inspections, grievance channels, and periodic audits.

Case-Style Snapshot: How Hop Luc Global Operates as a Vietnam Labour Export Company

Hop Luc Global JSC is structured for EU-grade delivery. While the pillar post details policy, this snapshot focuses on operational differentiators EU buyers can audit.

Governance & Licensing

- Valid export permits; corporate compliance monitored by internal QA.

- Digital archives for credentials and contracts with time-stamped access logs.

- Ethical recruitment policies aligned to international best practices.

Testing & Training Ecosystem

- EN-aligned trade tests and scoring rubrics; re-test and coaching loops.

- Sector modules for shipbuilding, energy/process plants, food/pharma utilities.

- Language tracks for workplace English/German; safety lexicon prioritized.

EU Project Support

- Bilingual supervision during ramp-up; KPI dashboards for retention and productivity.

- Welfare audits and incident-response playbooks to sustain performance.

- Client reviews and continuous improvement cycles per contract.

CTA: Request a no-obligation shortlist within 7–10 days based on your roles, codes, and timeline.

How to Brief Your Vietnam Labour Export Company for Best Results

A precise brief unlocks faster matching and higher first-pass success. Share the following inputs at kick-off:

Technical Inputs

- Trade mix, standards/codes, tools, and acceptable alternative processes.

- Language level per role; certification or medical prerequisites.

- Site specifics: shift pattern, climate, access, and security rules.

Operations & KPIs

- Milestones (week-by-week), acceptance criteria, and punch-list closure expectations.

- Reporting cadence and data format (daily/weekly dashboards).

- Replacement SLAs and on-site training provisions.

Welfare & CSR

- Accommodation standards, transport, tooling/PPE responsibilities.

- HSE orientation, grievance reporting, and supervisor language pairing.

- Community and integration support to stabilize retention.

FAQs: Choosing a Vietnam Labour Export Company in 2025

- How do I verify a licence? Ask for the licence number and scope, compare with official registers, and request a compliance letter dated within the last 6–12 months.

- What is a typical deployment timeline? 30–60 days from brief to arrival, depending on embassy capacity and role scarcity.

- What replacement guarantees are standard? 90–180 days with remediation first, then replacement at defined intervals.

- Which sectors are strongest in 2025? Shipbuilding/offshore, energy/process plants, logistics, hospitality, and selected healthcare roles.

- What language level should I request? A2–B1 workplace English for most industrial roles; higher levels for customer-facing positions.

EU buyers often compare rates but overlook rework, churn and audit delays. A proven Vietnam labour export company reduces those hidden costs by enforcing certification mapping, GDPR-secure files and welfare audits. The result: fewer punch items, faster validation, stronger CSR compliance — and a workforce that stays productive longer.

Get Started: Speak with a Vietnam Labour Export Company You Can Audit

If your program requires predictable deployment, auditable compliance, and sustained performance, partner with a Vietnam labour export company that treats manpower like an engineered product. Share your role profiles, codes, and schedule; we will return a shortlist plan within 7–10 days. For policy details and visa routes, revisit the Vietnam labour export guide 2025. Together we can convert skills shortages into reliable execution, from brief to site.

Contact us via:

-

Hotline: +84 983 688 060

-

Email: contact@hoplucglobal.com

-

WhatsApp: +84 983 688 060